Reference Cases

See more

See more

See more

See more

See more

See more

Comment from Bernard Delvaux, CEO of Etex: “In the first half of 2023, Etex coped with an overall slowdown of the construction sector – both in new build and renovation – triggered by several elements leading to high volatility and uncertainty such as inflation that puts pressure on consumers’ buying power, higher interest rates and more restricted loan policies by banks. However, Etex managed to record improved sales compared to the first half of 2022 through swift adaptations to challenging market contexts and cost-to-price monitoring. While our volumes are slightly impacted, margins remain strong.

This challenging environment did not stop us from making further progress on our strategic agenda to be the most innovative and sustainable global building material manufacturer. We completed significant acquisitions to support our position, and we identified clear growth paths for all our technologies, both organically and through new potential acquisitions. We are also making major progress on our sustainability journey and published our first-ever combined annual report presenting on an equal footing our economic, social and environmental footprint and performance.

For the rest of 2023, we will stay attentive and responsive on a month-per-month, country-by-country and product-by-product basis, to navigate the current uncertainty and likely continued market slowdown, particularly in Europe. We also see potential opportunities to grow across technologies and sustain our growth with a REBITDA margin expected to stay strong. These elements combined should help Etex keep delivering good results and help building living spaces that are ever safer, more sustainable, smart and beautiful.”

Uplift of top-line and profitability backed by price increases in volatile market

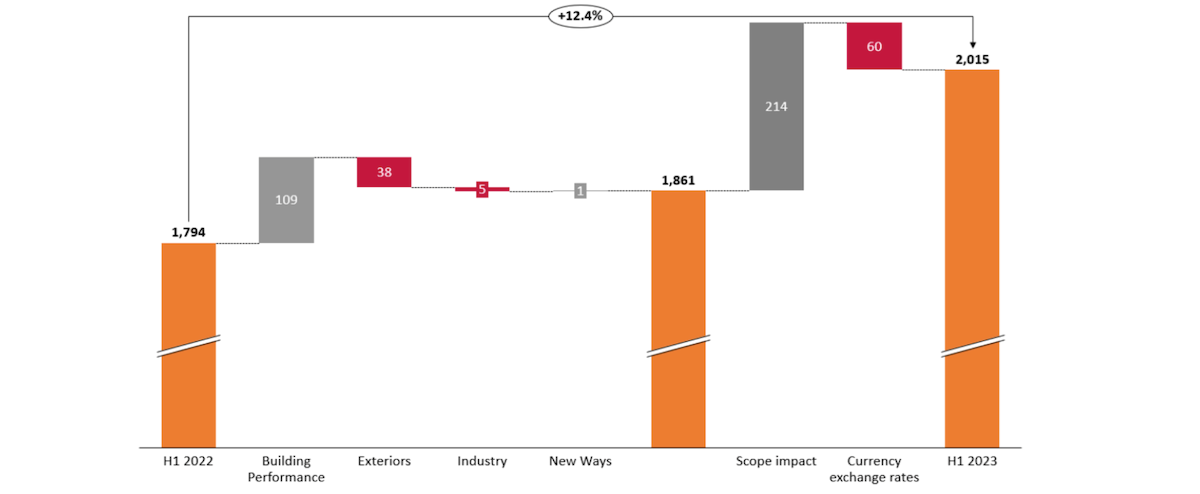

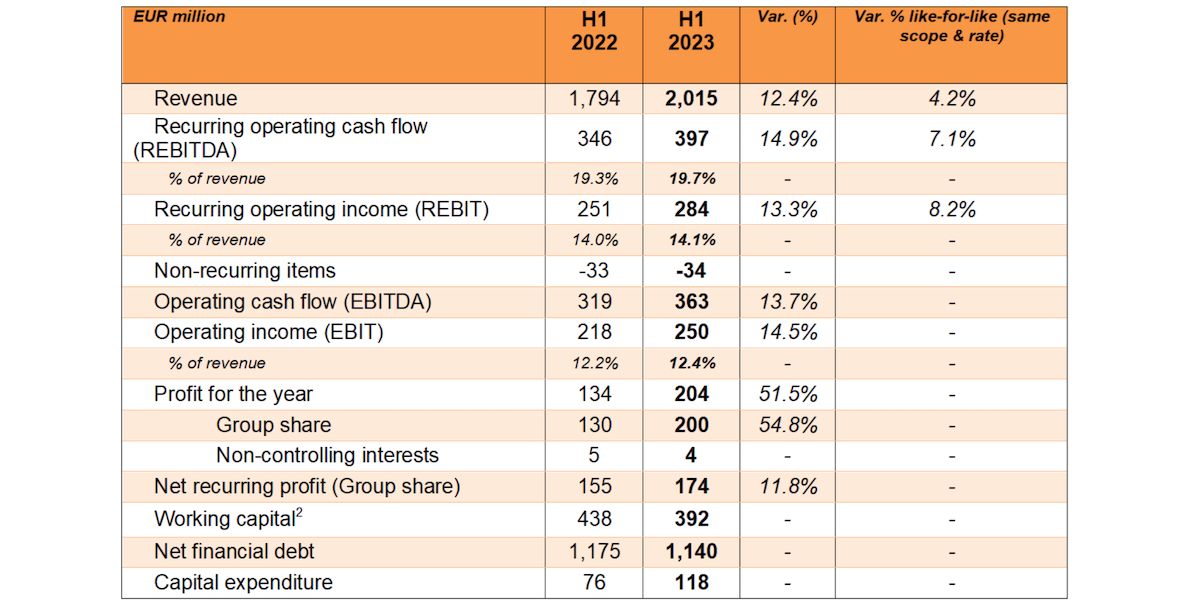

For the first six months of the year, Etex reported a revenue of EUR 2,015 million, an increase of 12.4% year-on year. Next to the impact of URSA’s acquisition last year, this growth is mostly attributable to increased average selling prices to face the significant and continued energy and raw material price inflation.

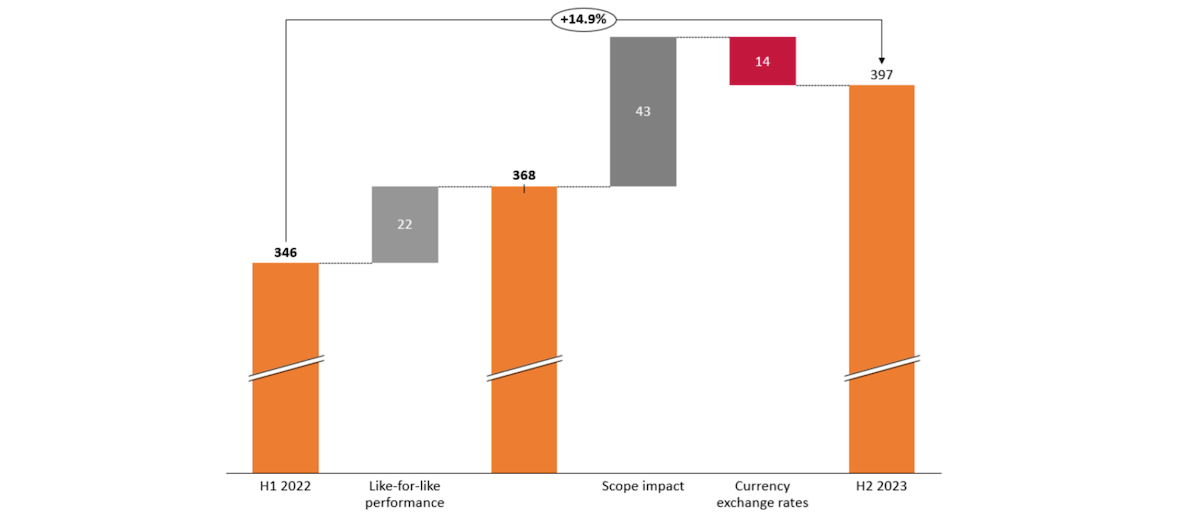

The recurring operating cash flow (REBITDA) reached a value of EUR 397 million, a year-on-year increase of 14.9%. This performance is mainly attributable to the strong top-line increase and the price increases implemented throughout the first semester. The REBITDA margin stood at an improved 19.7% of sales compared to 19.3% in the first half of 2022.

Etex’s net recurring profit (Group share) was up again, this time by 11.8% year-on-year to EUR 174 million. The company’s net profit reached EUR 198 million in the first half of 2023, up 46.8% year-on-year.

Over the last twelve months, Etex’s net financial debt slightly decreased from EUR 1,175 million at the end of June 2022 to EUR 1,140 million at the end of June 2023. This was possible thanks to a positive cash generation over the second half of 2022 and during the first six months of 2023, partially offset by the amounts of recent strategic acquisitions in May and June 2023, representing about a EUR 220 million increase in net debt. The net financial debt/REBITDA remains unchanged at 1.6x at the end of June 2023 compared to the same period in 2022.

Revenue by geography and division

Three of the five divisions (Building Performance, New Ways and Insulation) achieved revenue growth, with the two remaining divisions (Exteriors and Industry) recording decreases.

The Building Performance division, specialising in plasterboard and fibre cement boards, registered a like-for-like¹ revenue increase of 9.3% year-on-year to reach EUR 1,283 million. Despite slightly lower plasterboard volumes overall, the division delivered excellent sales in the first half of this year, benefitting from several price increases implemented in several phases throughout the period.

The Exteriors division, which focuses on fibre cement exterior solutions, decreased by 10.5% like-for- like¹ year-on-year to EUR 319 million. This is explained by lower volumes across the division’s categories.

The revenue of Etex’s Industry division, centered around fire protection and high performance insulation, decreased slightly by 4.6% like-for-like¹ year-on-year to reach EUR 114 million. This is explained by lower volumes across the division’s categories.

The Insulation division, which was created in May 2022 when Etex completed the acquisition of glass mineral wool and extruded polystyrene (XPS) manufacturer URSA, has contributed EUR 262 million to the revenue of Etex in the first half of the year. This contribution is included in the scope impact in the graphic above.

The revenue of the New Ways division, based on high-tech offsite solutions, increased by 2.4% like-for- like¹ year-on-year to EUR 37 million, with a good performance recorded by Sigmat, a UK market leader in light gauge steel framing. New Ways’ revenues exclude non-consolidated participations in several joint ventures, which have all been divested by the end of the first quarter of 2023.

Key developments

On the mergers, acquisitions and divestments side, the first six months of 2023 saw several important changes:

Within New Ways, the offsite construction manufacturing division, Etex finalised the divestment in its four joint venture companies in Latin America: E2E (Chile), Tecverde (Brazil), Icon Plus (Argentina) and Icon Plus (Ecuador). Following a decision by the commercial court of Saint-Brieuc (Brittany, France) in June, e-Loft is in liquidation. Etex is prioritising two-dimensional (2D) offsite systems and solutions, which show high potential.

In early May, Etex completed the acquisition of Skamol, a leading Danish manufacturer of fire protection and specialty insulation materials. This new acquisition further consolidates Etex’s portfolio of sustainable solutions in a market that is strongly supported by the need for energy efficient insulation products and solutions. Skamol and Etex are complementary in terms of products and geographies, allowing the combined organisations to broaden their offering in high-temperature insulation for building and industrial applications.

In late June, Etex, acquired Superglass, a top three player in the United Kingdom and Ireland in the growing glass mineral wool insulation market. Through this deal, Etex expands its already strong activities in the UK and complements the extensive European sales and production network of its Insulation division where it is already active with URSA.

In April, Etex released its first-ever combined annual report. In this report, the company presents on an equal footing its economic, social and environmental footprint and performance. The document highlights how Etex brought sustainable answers to the urgent challenges of 2022. Sustainability milestones include a decrease of almost 20% of absolute CO₂ emissions (scopes 1 and 2) and 26.5% less waste sent to landfill in the past five years.

More recently, in August, Etex completed its full exit from Russia by divesting its only two sites in the country. These sites were part of the original URSA footprint acquired a few weeks before the invasion took place. Russian activities accounted for less than 2% of Etex’s overall operations. Since the Russian invasion of Ukraine, Etex had been looking at all options to fully exit Russia, taking into account all aspects, including teammates working in the country. As soon as the invasion started in early 2022, Etex put all its Russian activities on a standalone basis with no contact with local management or financial transaction. It also stopped its small export of fibre cement products in the country, in line with the applicable sanction regulations. Etex has fully supported its 250 Ukrainian teammates and their families and is actively preparing to help rebuild Ukraine as soon as it is possible and safe to do so.

Cautious outlook and responsive approach for the rest of 2023 in an uncertain environment

Similar to the past months, Etex expects to experience a challenging rest of the year, due to a series of macroeconomic events whose full impact and developments remain difficult to assess: high inflation and interest rates, volatility in raw material markets, continued energy price increases, and a further slowdown in the construction sector. A volume slowdown is expected in most European countries. These elements can significantly impact Etex’s results. All sites, countries and divisions will continue to proactively manage their cost-to-price performance. However, like last year, the strong performance for the first six months of 2023 should allow Etex to still achieve growth for the full year.

Key figures for H1 2023¹

¹ The like-for-like percentages compare H1 2023 to H1 2022, the latter being converted with identical exchange rates, while excluding the impact of the newly acquired businesses in 2022 and in 2023, as well as the impact of the Ukrainian and Russian businesses being neutralised.

² Values are expressed excluding the favourable impact of the non-recourse factoring programme (EUR 212 million as of 30/06/2022 and EUR 287 million as of 30/06/2023).

All figures and tables contained in this appendix have been extracted from Etex' unaudited condensed consolidated interim financial statements for the first six months of 2023, which have been prepared in accordance with IAS 34 Interim Financial Reporting, as adopted by the European Union.

The statutory auditor, PwC Bedrijfsrevisoren BV / Reviseurs d’Entreprises SRL, represented by Peter Van den Eynde, has reviewed these condensed consolidated interim financial statements and concluded that based on the review, nothing has come to the attention that causes them to believe that the condensed consolidated interim financial information is not prepared, in all material respects, in accordance with IAS 34, as adopted by the European Union.

For the condensed consolidated interim financial statements for the first six months of 2023 and the review report of the statutory auditor we refer to Etex' website.

Follow #PromatAsiaPacific on LinkedIn: