Reference Cases

See more

See more

See more

See more

See more

See more

Comments from Bernard Delvaux, CEO of Etex: “I am proud to report that Etex delivered yet again significant growth in 2022, and this for the fifth year in a row. After an exceptional 2021 year, we achieved new record results, including in revenue, REBITDA and net recurring profit. This was reached despite an unfavourable business context that includes a world still recovering from the COVID-19 pandemic, the invasion of Ukraine by Russia, an energy crisis, and global inflation. Our lightweight construction solutions prove to be a great fit to answer the current needs in both renovation and new build given their intrinsic sustainable value. Etex’s products are up to 45% less emission intensive to produce compared to traditional construction methods, they provide up to seven times better thermal and sound insulation which increases energy-efficiency and emissions, and they are more recyclable, flexible and adaptable. In a nutshell, in 2022 Etex properly addressed urgent challenges in a volatile market while following a growth path to a sustainable future with our lightweight construction portfolio.

Our promising results can be explained by several key contributors. Sales growth was particularly driven by some of our recent acquisitions, namely European insulation expert URSA in 2022 and the Australian plasterboard business in 2021. Our positive margins show agility and responsiveness through cost-to-price monitoring and swift adaptations to challenging market contexts. We were also successful in implementing a cautious approach on overhead costs while energy prices remained under control through an effective hedging strategy. Finally, faced with demand volatility, Etex showed impressive manufacturing agility across its more than 140 sites around the world. When looking back at Etex’s growth over the past years, it has been nothing short of impressive. Our dedicated focus to be a pioneer and leader in lightweight construction solutions has allowed the company to grow significantly.

Next to this financial success, 2022 was also a year of other important moments for Etex. We launched our Road to Sustainability 2030 commitments, with clear targets and first progresses in terms of safety and well-being, diversity and inclusion, circularity, decarbonisation and customer engagement. We improved again our ESG risk rating to reach the top 10 in our industry group worldwide. Since 2018 we made significant progress on our sustainability journey, including through 54% more recycled gypsum used - making Etex the most advanced gypsum recycler across Europe, including the UK -, a decrease by 19.9% of absolute CO2 emissions and a reduction of waste sent to landfill by 26.5% in absolute value. Moreover, as soon as the conflict in Ukraine erupted, we immediately launched a support program for our 250 Ukrainian teammates and their families while taking a firm position on Russia. On pages 6 to 8 more details are shared on our achievements across our four strategic drivers of engaged people, operational excellence, customer experience and commercial excellence, as well as sustainability and innovation.

For 2023, volatility and uncertainty are expected to remain, particularly for energy and raw material prices, but we believe that demand for Etex’s products and solutions will remain strong given their intrinsic sustainable value and the ongoing needs in renovation and new build. We therefore stay extremely attentive, agile and responsive on a month-per-month, country-by-country and product-by-product basis to navigate this uncertainty. We also see potential opportunities to grow across technologies and sustain our growth with a REBIDTA margin expected to stay strong. We have a clear focus to be the most innovative and sustainable global building material manufacturer. These elements combined should help Etex keep delivering good results and help building living spaces that are ever safer, more sustainable, smart and beautiful.”

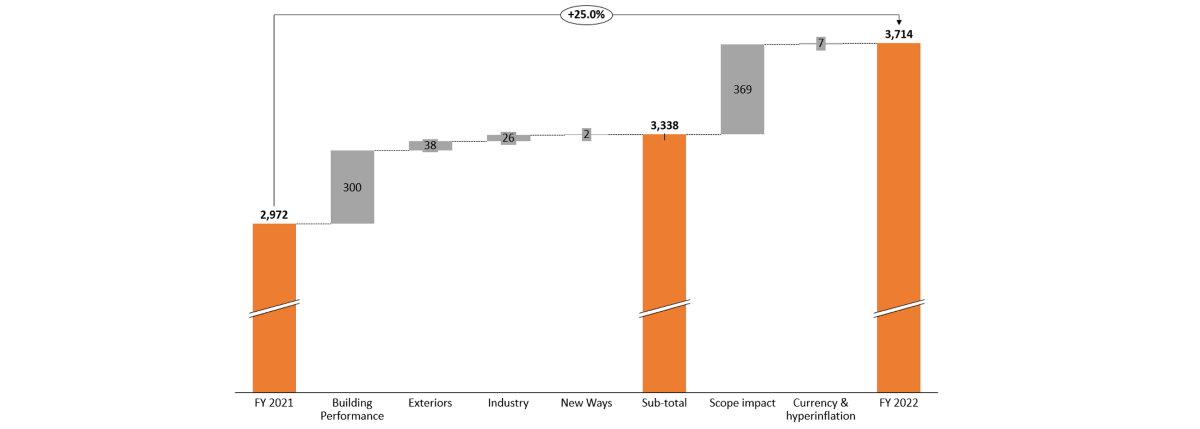

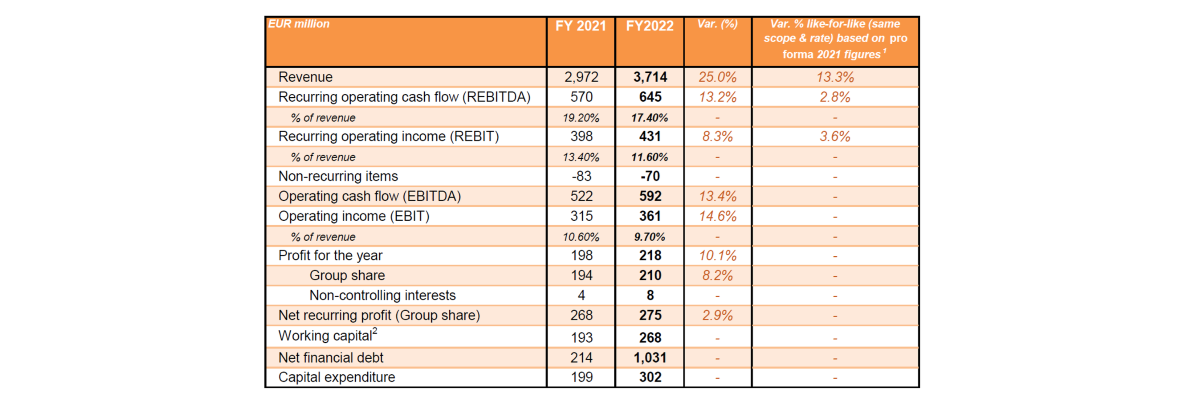

In 2022, Etex recorded a revenue of EUR 3.741 billion. When including the impact of scope changes, translation, hyperinflation and despite the deterioration of Etex’s Ukrainian and Russian activities, the year-on-year revenue increase reached 25%. Like-for-like¹ (same currency exchange rates and scope) this represents a revenue increase of 13.3%. This performance is attributable to stable volumes and increased average selling prices. The 11.5% net positive scope impact compared with 2021 is attributable to additional volumes from Etex’s recent acquisitions, namely URSA and the Australian plasterboard activities.

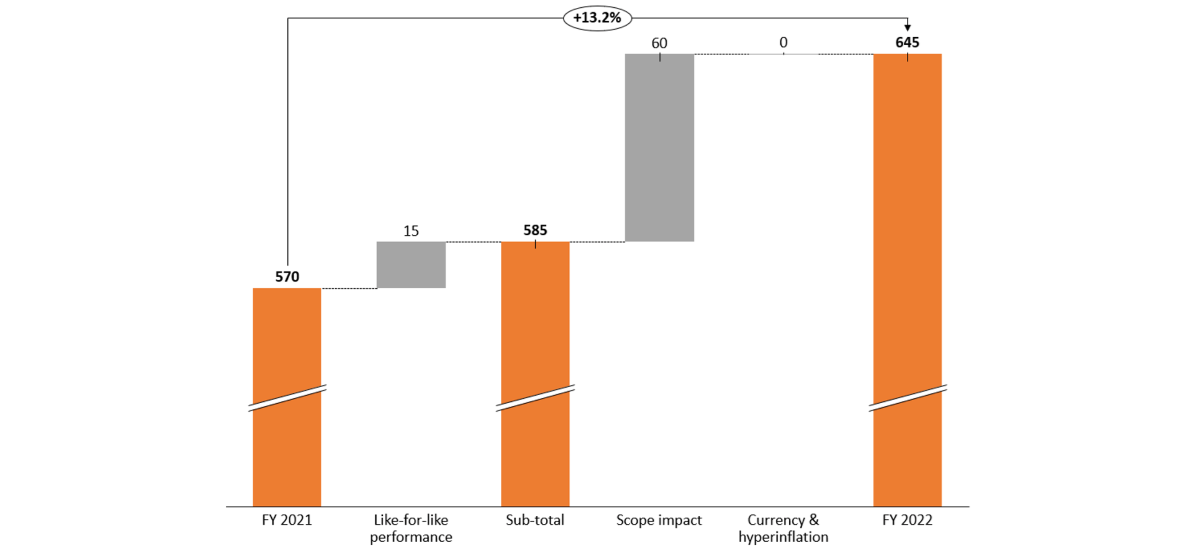

The recurring operating cash flow (REBITDA) reached EUR 645 million, its highest absolute value ever, for a 13.2% increase. This performance is mainly attributable to increased revenues, jointly with the positive impact of the acquisition of European insulation leader URSA. This represents a like-for-like¹ increase of 2.8% versus 2021. The REBITDA also reached 17.4% in terms of percentage of sales, compared to 19.2% in 2021.

Etex’s net recurring profit (Group share) was up by 2.9% year-on-year to EUR 275 million in 2022. The company’s net profit reached EUR 210 million in 2022, up 8.2% year-on-year.

At the end of December 2022, Etex’s net financial debt reached EUR 1.031 billion, compared to EUR 214 million at the end of December 2021. This increase was mainly driven by the acquisition of European insulation leader URSA but partially offset by free cash flow generation. To finance this acquisition, Etex finalised in June 2022 its first ESG-linked Schuldschein issue, raising EUR 800 million. This represents the largest-ever ESG-linked Schuldschein issue by a non-German speaking company.

At the Shareholders’ Meeting on 24 May 2023, the Board of Directors of Etex will propose a gross dividend increase on the 2022 profit with 10.7% to EUR 0.93 per share.

All divisions have achieved revenue growth in all regions, with the exception, for the division Exteriors, of Chile, the United Kingdom, Spain, Peru and the Nordic countries.

Building Performance registered a like-for-like¹ revenue increase of 15.5% to reach EUR 2,434 million. The division’s market positions and business results evolved positively in 2022, including in the recently acquired Australian plasterboard activities. The division demonstrated leadership when facing raw material price increases. Despite a difficult third quarter, the division achieved a strong first half and finished the year strong.

Exteriors registered a like-for-like¹ revenue increase of 6.1% at EUR 683 million, mainly attributable to efficient price management mitigating the impact of raw material cost increases together with volume increase in North America. The division also posted significant double-digit growth in North America and Australia and single-digit growth in Europe but recorded a decline in Latin America.

Industry’s revenue amounted to EUR 203 million, up by 14.8% like-for-like¹. All of the division’s segments (transportation, thermal process industry, energy and fire-rated applications and appliances) grew in 2022. This can mainly be explained by price management as well as a healthy growth in volume with many projects being continued from 2021.

Etex’s newest and fifth division, Insulation, recorded a revenue of EUR 312 million in its first seven months. With European insulation leader URSA in its portfolio as of June 2022, the division was able to offset negative effects, market disruptions and the war in Ukraine. The early months saw very strong volumes, followed by modest drops. Insulation’s results were impacted by issues surrounding inflation, gas, power and raw materials but the energy savings aspect of insulation made its products - glass wool and extruded polystyrene (XPS) - even more attractive than previous years.

The New Ways division recorded a revenue of EUR 83 million in 2022 up by 10.3% like-for-like¹, particularly driven by a UK and Ireland market very welcoming to offsite construction and backed by a government push. 2022 was the first year all companies contributed a hundred percent to the New Ways division and Etex, following 2021’s acquisitions. Overall, sales were up in 2022 markedly versus the previous year, as were steel prices which also had an impact.

On the mergers, acquisitions and divestments side, 2022 saw important developments:

In ten years, since 2012, Etex has completely focused its activities to become a pioneer and leader in lightweight construction solutions. This happened through the exit of the clay and concrete tiles business, the acquisition of plasterboards assets across Europe and Australia, the creation of the New Ways Division driving Etex’s modular and offsite ambitions, expanding in passive fire protection and lastly acquiring URSA’s glass wool and XPS insulation assets in Europe.

The acquisition of URSA in 2022 enabled Etex to further refine its strategic framework, which focuses on four drivers across five technologies: gypsum, fibre cement, passive fire protection and high-performance insulation, insulation, and systems and solutions.

First of all, Etex’s achievements in 2022 related to its “Sustainability and Innovation” driver encompass the launch of its Road to Sustainability 2030 approach. Etex’s sustainability goals are ambitious, and the company worked hard to translate them into dedicated workflows, clear action plans and targets. They are organised across five priority areas:

Next to this, Etex achieved an improved ESG risk rating from Sustainalytics of 17.0, compared to 18.1 in 2021. It is the fourth time in a row that Etex has improved its score and puts the company in the top 10 of the "Construction Products" category. Should Etex be added today in the newly created Euronext BEL® ESG index which tracks Brussels-listed companies’ ratings, the company would score at least better than 7 out of 20 of them. Between 2018 and 2022, Etex made significant progress on its sustainability journey, including through 54% more recycled gypsum used - making Etex the most advanced gypsum recycler across Europe, including the UK -, a decrease by 19.9% of absolute CO2 emissions, and a reduction of waste sent to landfill by 26.5% in absolute value.

When it comes to its “Engaged people” priority, Etex is proud to have taken immediate supportive actions for its 250 Ukrainian teammates and their families as soon as the conflict started in their country. These actions include daily contacts, help to move within Ukraine or Europe, financial support, job relocations, training and fund raising. The third edition of the ‘Me & Etex’ employee engagement survey registered again a high 84% participation rate and showed an 84% engagement rate across Etex, a 1% decrease compared to last year but still 4% above the global manufacturing norm. The results show resilience in teams after two years of COVID-19 and will help Etex to further improve on its engagement journey. The company also continued to acknowledge outstanding performances of its teammates through the Etex Awards, which in 2022 were won by the Etex Maipú plant in Chile. Through a Europe-wide roadshow, Etex successfully onboarded more than 1,500 new teammates from URSA, making them truly part of Etex as of day one.

Etex’s “Operational excellence” focus in 2022 required an adaptation to extreme uncertainties. Through the agility of its plants to demand volatility Etex was able to deliver to its customers and keep service and inventories under control. Etex, including through its purchasing and supply chain teams, conducted an intensive review of the cost drivers of its products and delivered savings accordingly while keeping a strong control of energy prices in a volatile context. In 2022, Etex prepared for the future by investing a record EUR 302 million in capital expenditure projects (versus EUR 199 million in 2021) to maintain factories, increase production capacity and make plants more sustainable in terms of CO2 emissions, circularity and safety. After several good years in terms of safety performance, Etex sadly recorded a disappointing year with an increase in the frequency of lost-time accidents and the total frequency of lost-time and medical aid accidents. These results push Etex to further focus on its strong safety culture, reducing high risks in its factories and reach zero accident.

To improve “Customer experience and Commercial excellence”, Etex carried out regular review of product costing to restore competitiveness in markets where it was necessary. Unprecedented input factor increases required strong price management. To deal with an ever-changing demand during the year, Etex improved its supply chain processes. Following a strong focus on customer journeys, the company also recorded strong Net Promoter Scores (NPS) - measuring customer loyalty, satisfaction, and enthusiasm - in many key countries despite a challenging situation. Finally, on the innovation side, Etex refined and prioritised its innovation pipeline, developed specific product roadmaps for go-to-market and digital, and deployed several new products, including new high-performance plasterboards.

Etex expects volatility and uncertainty to remain, particularly for energy and raw material prices, but believes that demand for its products and solutions will remain strong given their intrinsic sustainable value and the ongoing needs in renovation and new build. The company will therefore stay extremely attentive, agile and responsive on a month-per-month, country-by-country and product-by-product basis. Etex also sees potential opportunities to grow across technologies and sustain its growth. With a clear focus to be the most innovative and sustainable global building material manufacturer, Etex anticipates to keep delivering results and help building living spaces that are ever safer, more sustainable, smart and beautiful.

The mandate as Independent Directors of MucH BV, represented by its permanent representative Muriel De Lathouwer, and ViaBylity BV, represented by its permanent representative Hans Van Bylen, will be proposed to be renewed at the Shareholders’ Meeting of 24 May 2023.

¹ The like-for-like percentages compare FY 2022 to FY 2021, the latter being converted with identical exchange rates, while excluding the impact of hyperinflation, of the newly acquired URSA business in 2022, and the Australian and New Ways acquisitions of 2021, as well as the impact of the Ukrainian and Russian businesses being neutralised.

² Values are expressed excluding the favourable impact of the non-recourse factoring programme (EUR 259 million as of 31/12/2022 vs EUR 167 million for the prior year).

The consolidated financial statements for the year 2022 will be approved by the Board of Directors on 30 March 2023 and will be presented for approval at the Shareholders’ Meeting.

The statutory auditor, PwC Bedrijfsrevisoren bv, represented by Peter Van den Eynde has confirmed that the audit, which is substantially complete, has not to date revealed any material misstatement in the draft consolidated statement of financial position, consolidated income statement and consolidated statement of comprehensive income, and that the accounting data reported in the press release is consistent, in all material respects, with the draft consolidated statement of financial position, consolidated income statement and consolidated statement of comprehensive income, from which it has been derived.

The Consolidated income statement, Consolidated statement of comprehensive income and Consolidated statement of financial position can be found in annex on pages 11 and 12.

The 2022 Annual Report of the company will be available on Etex’s website as of 6 April 2023.

Follow #PromatAsiaPacific on LinkedIn: