Reference Cases

See more

See more

See more

See more

See more

See more

Comment from Bernard Delvaux, CEO of Etex: “In the first half of 2022, like many other industrial players, Etex had to cope with significant raw material and energy price inflation in the context of post-COVID disruptions and volatility and the war between Russia and Ukraine. To face this situation, we had to implement a number of price increases. Our volumes and margins have been impacted, but these measures allowed us to achieve a positive evolution of both top line and bottom line.

This challenging environment didn’t stop us from making major strides on our strategic agenda. In May we completed the acquisition of URSA, the European leader in extruded polystyrene (XPS) and a top 3 player for glass mineral wool. URSA sits firmly at the forefront of global sustainability efforts, providing proven, workable solutions with the strongest sustainability performance overall compared to other insulation materials. In the first quarter of the year, we have accelerated our focus on our strategic shift towards sustainability, by setting up dedicated workstreams and defining clear ambitions for 2025-2030. Structured around our five priority areas (health, safety and well-being; decarbonisation; circularity; diversity, equity and inclusion; and customer engagement), these ambitions notably include the use of more than 20% of circular input as raw material, zero waste being sent to landfill, using 100% recycled packaging material or reducing our greenhouse gas emissions’ intensity (scope 1 and 2) by 35% compared to 2018. These ambitions as well as the company’s progress and achievements will be shared in detail in our second Sustainability Report, which will be published later this month.

We must however remain cautious when assessing the financial performance of Etex over the full year. The ongoing volatility in raw material markets, energy price increases and availability of energy and materials could increasingly impact our results, together with lower demand. All divisions will continue to proactively manage their cost-to-price performance which is key in the current high inflation context. We also believe that the potential adversity that we could face in the second half should only partially offset the strong performance recorded in the first half and allow Etex to still achieve growth for the full year.”

Uplift of top-line and profitability backed by price increases in a tough environment

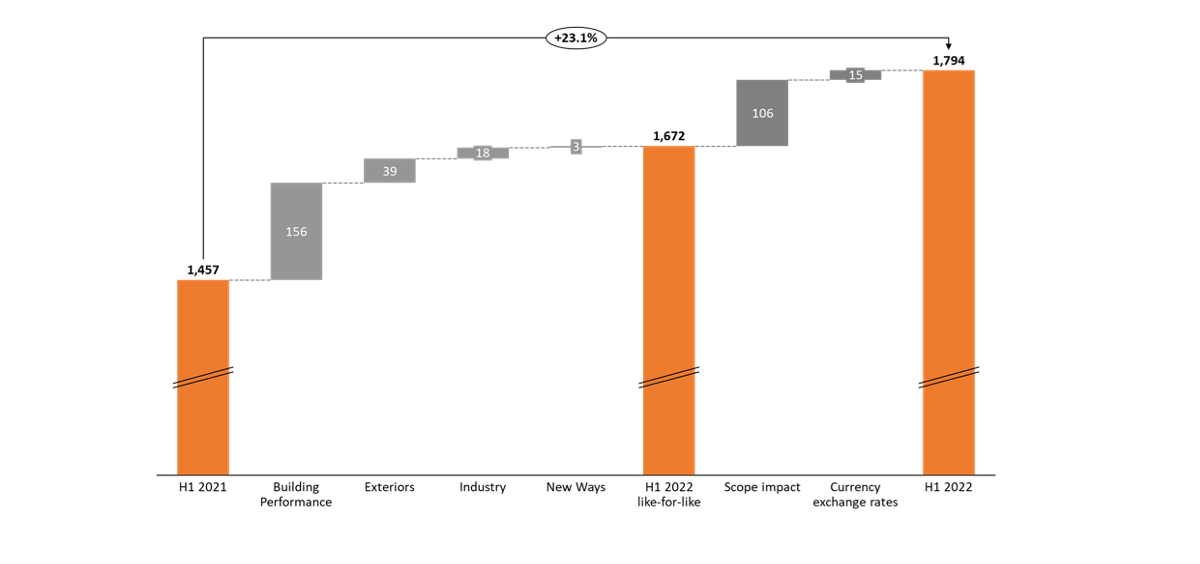

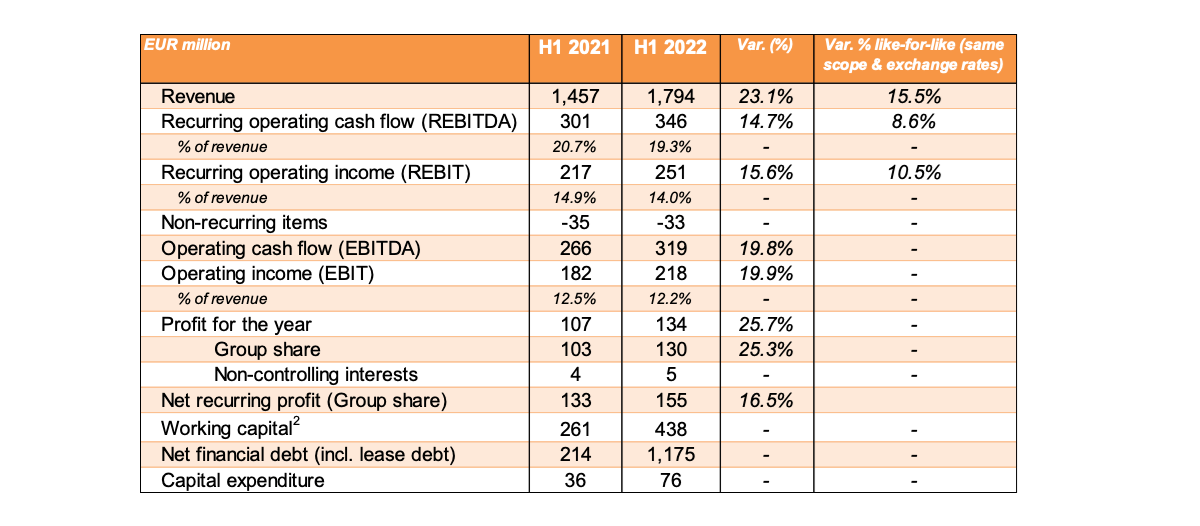

For the first six months of the year, Etex reports a revenue of EUR 1.794 billion, a like-for-like increase of 15.5% year-on year¹. This growth was recorded in all divisions and geographies and is mostly attributable to increased average selling prices. Several price increases have been implemented throughout the period in order to face the significant raw material and energy price inflation, which is the result of both post-COVID disruptions and volatility and the war between Russia and Ukraine. The positive scope impact (+6.5%) is attributable to several acquisitions (major plasterboard business in Australia, E-loft, Evolusion Innovation, Horizon Offsite, Sigmat and URSA). The remaining favourable impact on revenue (+1.1%) is attributable to a positive currency translation from all foreign currencies except the Chilean and Argentinian peso and the Polish złoty. Including the impact of the change of scope and currency exchange rates, the revenue was up 23.1% year-on-year.

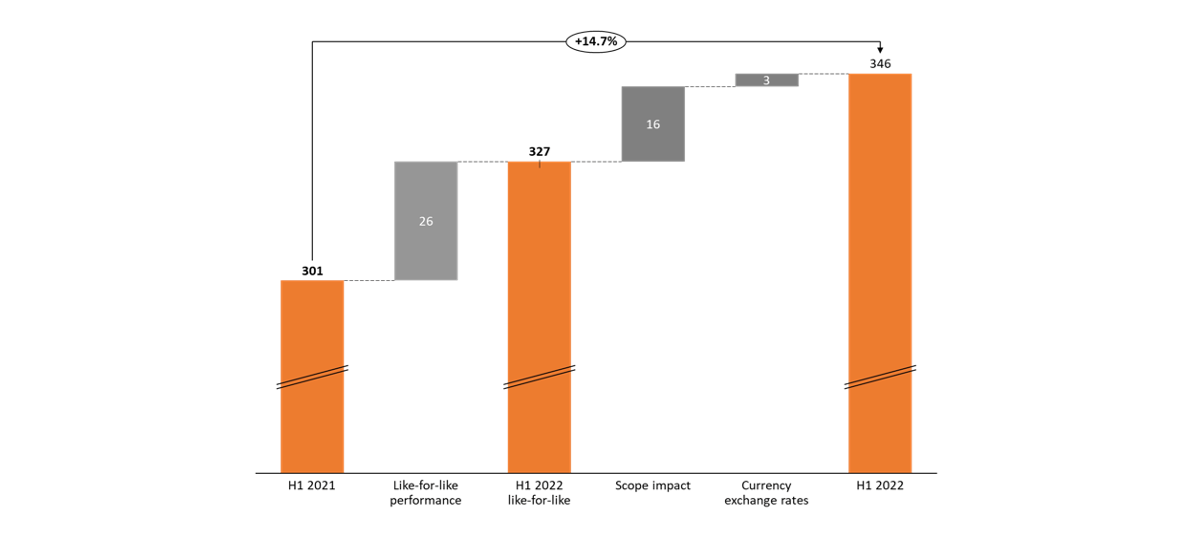

The recurring operating cash flow (REBITDA) reached a value of EUR 346 million, a like-for-like increase of 8.6% year-on-year¹. This performance is mainly attributable to the strong top-line increase and the price increases implemented throughout the period. Despite these, the REBITDA margin was negatively impacted by significant raw material and energy price inflation. Overheads were contained in proportion to sales but increased in H1 2022 vs. H1 2021 due to the normalisation of the pandemic in most of our operational countries as well as to the inflation. The REBITDA margin stood at 19.3% of sales compared to 20.7% – its highest level ever – in the first half of 2021.

Etex’s net recurring profit (Group share) was up by 16.5% year-on-year to EUR 155 million in the first half of 2022. The company’s net profit reached EUR 134 million in H1 2022, up 25.7% year-on-year.

Over the last twelve months, Etex’s net financial debt strongly increased from EUR 214 million at the end of June 20211 to EUR 1,175 million at the end of June 2022. This increase is mainly the result of several acquisitions which were made during the period (URSA in particular). The net financial debt/REBITDA (rolling 12 months, pro forma including URSA estimates for 12 months) ratio increased from 0.4 x at the end of June 20211 to 1.6 x at the end of June 2022. Including the non-recourse factoring debt, this ratio increased from 0.7x to 1.9x.

Revenue by geography and division

All divisions have achieved revenue growth in all regions, with the exception of the UK, Chile and Peru (Exteriors) as well as Asia (Industry and Building Performance’s fibre cement business) except Japan and India.

Building Performance registered a like-for-like revenue increase of 16.0% year-on-year to reach EUR 1,225 million. Despite slightly lower plasterboard volumes, the division delivered excellent results in the first half of this year, benefitting from several price increases which were implemented in several phases throughout the period in order to face the significant raw material and energy price inflation. The fibre cement and Promat businesses performed well.

The revenue of our Exteriors division increased with 12.2% like-for-like year-on-year to EUR 369 million. The division delivered an excellent sales performance backed by volume growth in the Equitone segment and selling price increases. Growth has been particularly strong in Eastern Europe and the Benelux, whereas the UK, Peru and Chile were down year-on-year.

Our Industry division’s revenue increased significantly with 20.6% like-for-like year-on-year to reach EUR 106 million. Having suffered a lot last year from the impact of the COVID-19 pandemic (especially in the AMEA region), the division benefitted from a strong sales upswing in all segments and from price increases.

The revenue of our New Ways division increased with 40.4% like-for-like year-on-year to EUR 45 million, with a good performance recorded by our EOS business (steel frame solutions) in the UK driven by growing volumes and prices. New Ways revenues exclude our non-consolidated participations in several joint ventures.

The Insulation division, which was created in May 2022 when Etex completed the acquisition of URSA (read more below), has contributed EUR 50 million to the revenue of Etex in the first half of the year – this contribution is included in the scope impact in the graphic above.

Key developments

At the beginning of the year, Etex has reached a major milestone on its strategic roadmap focusing on lightweight and more sustainable building solutions, with the acquisition of URSA. The company is a European leader in glass mineral wool and extruded polystyrene (XPS), present in more than 20 countries based on a network of 13 production operations. The operation signals our entry into the glass mineral wool and extruded polystyrene (XPS) insulation business, which is integrated as a separate division. Demand for insulation materials is being driven by EU regulations to tackle global warming. The acquisition has been completed at the end of May. Since then, URSA teammates have been warmly welcomed into the Etex group through several successful townhalls, roadshows and other events.

In June, Etex successfully finalised its third Schuldschein issue, raising EUR 800 million. It is Etex’s first environmental, social and governance-linked Schuldschein issue and it represents the largest-ever ESG-linked Schuldschein issue by a non-German speaking company. A Schuldschein is a privately placed, medium to long-term unsecured debt governed by German law. The placement comprises three euro-denominated tranches with maturities of 3, 5 and 7 years, at fixed and floating rates. Despite the difficult geopolitical and challenging interest rate environment, the issue was oversubscribed several times. The proceeds of the Schuldschein will be used to finance a large portion of the acquisition of URSA. The balance of the acquisition will be financed through available cash and existing unused credit facilities.

Cautious outlook for FY 2022 in a challenging and uncertain macroeconomic context

Etex expects to experience a challenging second half of the year, due to a series of macroeconomic events whose impact are difficult to assess: the volatility in raw material markets, energy price increases and availability of energy and materials in the context of the current war between Russia and Ukraine and potential disruptions linked to new COVID-19 variants. These different elements could increasingly impact our results, together with lower demand. All divisions will continue to proactively manage their cost-to-price performance which is key in the current high inflation context. We also believe that the potential adversity that we could face in the second half should only partially offset the strong performance recorded in the first half should allow Etex to still achieve growth for the full year.

Later this month, Etex will release its second Sustainability Report, in line with the requirements of the Global Reporting Initiative (GRI), which will unveil its ambitious ‘Road to Sustainability 2030’ objectives. This major milestone confirms the group’s strategic shift towards more sustainable building solutions.

Key figures for H1 2022¹

¹ The June 2021 comparative figures in this press release differ from the figures disclosed in the 2021 half-year results. This is due to the fact that half-year 2021 internal reporting values had to be adjusted to comply with the IAS 34 Interim financial reporting standard and compare with half-year 2022 values. The differences include the accounting treatment of business combination (E-loft in January 2021, the Australian plasterboard business in February 2021 and Evolusion Innovation in April 2021), the timing of recognition of one-off events (restructuring, disposal of assets, change in tax rates), the hyperinflation accounting treatment for Argentina and the presentation of non-recourse factoring financing, aligned with year-end in half-year financial statements.

² Values are expressed excluding the favourable impact of the non-recourse factoring programme (EUR 176 million as of 30/06/2021 and EUR 212 million as of 30/06/2022).

All figures and tables contained in this appendix have been extracted from Etex' unaudited condensed consolidated interim financial statements for the first six months of 2022, which have been prepared in accordance with IAS 34 Interim Financial Reporting, as adopted by the European Union.

The statutory auditor, PwC Bedrijfsrevisoren BV / Reviseurs d’Entreprises SRL, represented by Peter Van den Eynde, has reviewed these condensed consolidated interim financial statements and concluded that based on the review, nothing has come to the attention that causes them to believe that the condensed consolidated interim financial information is not prepared, in all material respects, in accordance with IAS 34, as adopted by the European Union.

For the condensed consolidated interim financial statements for the first six months of 2022 and the review report of the statutory auditor we refer to Etex' website.

Follow #PromatAsiaPacific on LinkedIn: