Reference Cases

See more

See more

See more

See more

See more

See more

Comment from Bernard Delvaux, CEO of Etex: “In 2021, and for the fourth year in a row, I am pleased to report that Etex delivered significant growth. The company reached record results in revenue, REBITDA, REBITDA margin and net recurring profit, while the level of free cash flow generation reached new heights compared to 2019 – 2020 being an “abnormal year” due to the COVID-19 pandemic. These outstanding results can be attributed to a number of factors: a booming demand (especially in the home repair and renovation segment); increased margins thanks to cost-to-price monitoring and increased efficiency in manufacturing activities; and the positive impact of the savings initiatives launched in 2020. More importantly, the results tell us that people still dream about a better place to live, inspired by Etex.

The company’s financial performance is only one of our many successes last year. Firstly, we have had a busy M&A agenda, with the acquisitions of a major plasterboard business in Australia as well as four offsite and modular construction specialists in Europe. Early this year, Etex acquired thermal and acoustic insulation expert URSA, the European leader in extruded polystyrene (XPS) and featuring among the top 3 for glass mineral wool – this deal is still subject to customary closing conditions. The acquisition of URSA concludes Etex’s complete shift in its portfolio of activities since 2018, when we redefined our ambition of becoming a global player in lightweight and sustainable building solutions.

We have also reached significant milestones in the four drivers of our new strategic framework, including in the areas of employee engagement, reward and recognition, physical and mental well-being of our teammates, safety, supply chain, manufacturing, capacity increases, digital solutions for our customers, and sustainability. More details on these topics are shared on pp. 6 to 8.

For 2022, although we expect demand to remain strong in the first half, we must remain cautious. Volatility has become the “new normal”, as proven by the ongoing surge in raw material and energy prices and the current war between Russia and Ukraine. The impact of these events is global – crossing borders and economic sectors – and cause a lot of uncertainty. Nevertheless, Etex’s strong strategic focus, quality of products and solutions, and engaged teams allow us to remain optimistic.”

In the Annual Report dedicated to our performance and achievements in 2021, we have highlighted four ‘Inspiring stories’:

To complement the Annual Report, readers can discover a video where six Etex teammates explain how the company cared about people, performance, strategy, commercial excellence, supply chain, and our communities.

Watch the video and/or download the full Annual Report

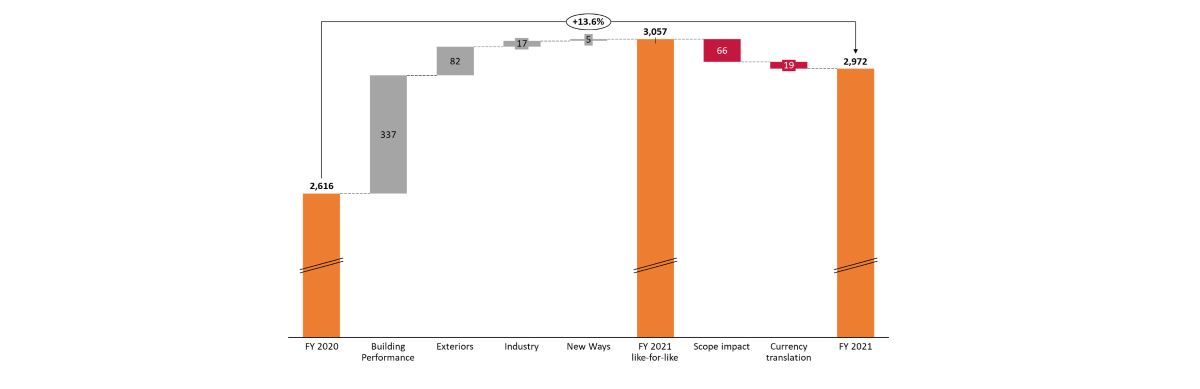

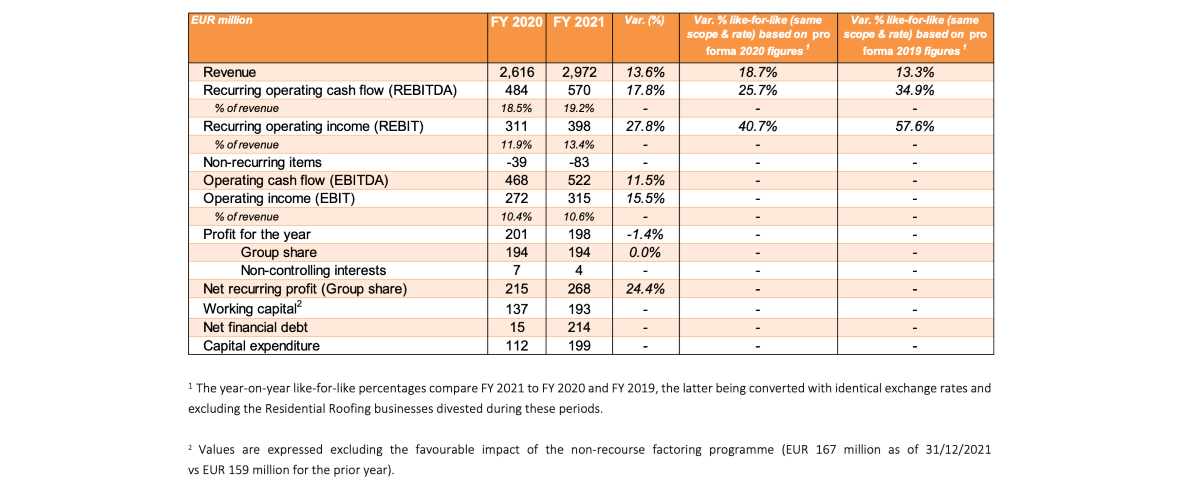

In 2021, Etex recorded a like-for-like (same currency exchange rates and scope) revenue increase of 18.7% year-on-year¹ (and of 13.3% compared to 2019) to EUR 2.972 billion. This strong performance is mainly attributable to growing volumes and increased average selling prices. The 4.3% net negative scope impact compared with 2020 is mainly attributable to the disposal of our Residential Roofing businesses in Germany, Hungary, Poland, Belgium and South Africa in 2020, partially offset by the acquisitions – all made in 2021 – of a major plasterboard business in Australia, which has been integrated to our Building Performance division, as well as of the French offsite construction company E-loft, the Irish steel framing company Horizon Offsite, the design and engineering consultancy company Evolusion Innovation, and the UK light gauge steel framing market leader Sigmat, which have all joined our New Ways division. The remaining negative impact on revenue of 0.8% is due to foreign currency translation, mainly from a weaker Argentinian peso, Peruvian sol and Nigerian naira. When including the impact of scope and currency translation as well as the contribution of the Residential Roofing businesses in 2020, the year-on-year revenue increase reached 13.6% (and 1.1% compared to 2019).

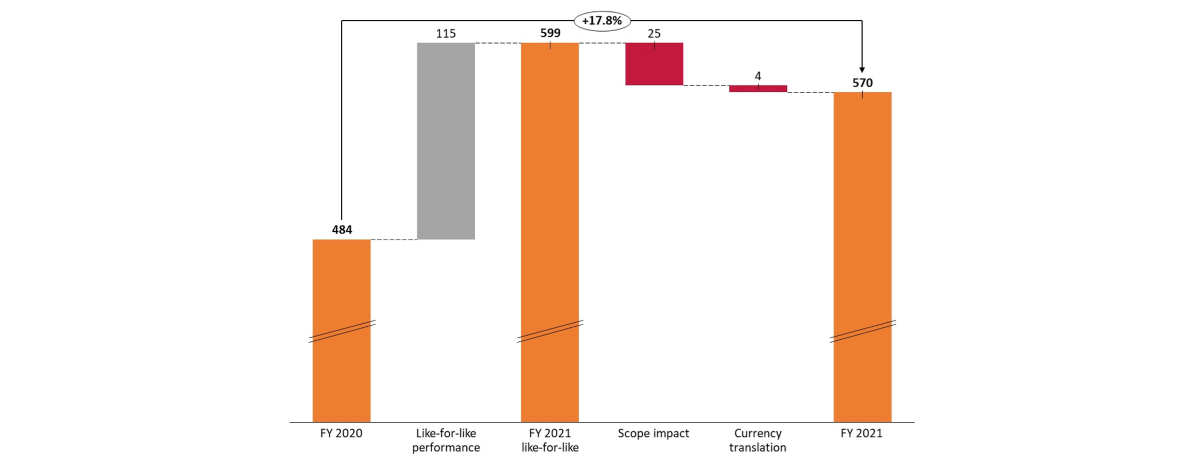

The recurring operating cash flow (REBITDA) reached EUR 570 million, its highest absolute value ever. This represents a like-for-like increase of 25.7% year-on-year¹, and of 34.9% compared to 2019. The REBITDA also reached its highest value ever in terms of percentage of sales at 19.2%, compared to 18.5% in 2020 and 16.4% in 2019. This outstanding performance is mainly attributable to the significant revenue and margin increase combined with controlled overheads. Margins remained strong thanks to cost-to-price monitoring and increased efficiency in manufacturing activities. The company’s profitability was also positively impacted by the savings initiatives launched in 2020 to reduce overheads, which resulted, together with the revenue increase, in an overheads ratio of 18.6% of sales in 2021, compared to 20.7% both in 2020 and 2019. Compared to 2020, the REBITDA was negatively impacted by scope changes (-7.1%) and foreign currency translation (-0.8%). When including the impact of scope and currency translation as well as the contribution of the Residential Roofing businesses in 2020, the year-on-year REBITDA increase reached 17.8% (18.0% compared to 2019).

Etex’s net recurring profit (Group share) was up by 24.4% year-on-year (and by 43.1% compared to 2019) to EUR 268 million in 2021, another record performance. The non-recurring items mainly relate to impairments relating to New Ways companies, where growth is expected later than initially planned, restructuring charges relating to industrial footprint adjustments, and costs incurred in various projects to renovate asbestos-containing sites and properties. The company’s net profit reached EUR 198 million in 2021, down 1.4% year-on-year (up 9.8% compared to 2019).

At the end of December 2021, Etex’s net financial debt reached EUR 214 million, an increase of EUR 199 million compared to its level at the end of December 2020 (EUR 15 million). The strong free cash flow generation was mainly offset by the acquisition of the Australian plasterboard business and, to a lesser extent, the acquisition of the four New Ways businesses. The net debt in 2021 includes the favourable effect of the non-recourse factoring programme, which amounted to EUR 167 million at the end of the year (vs EUR 159 million at the end of 2020). Excluding this programme, the net financial debt would have reached EUR 381 million (vs EUR 174 million at the end of 2020). The company’s adjusted net financial debt/REBITDA ratio increased from -0.2x in 2020 to 0.1x in 2021. Excluding the favourable impact of the non-recourse factoring programme, this ratio increased from 0.4x to 0.7x year-on-year.

At the Shareholders’ Meeting on 25 May 2022, the Board of Directors of Etex will propose a gross dividend increase on the 2021 profit with 20% to EUR 0.84 per share.

Building Performance registered a like-for-like¹ revenue increase of 20.6% (+15.4% vs 2019) to reach EUR 2,099 million, with volume growth in plasterboard, fire protection and fibre cement boosted by the booming renovation markets, economic recovery after COVID-related lockdowns were lifted and some shortages of alternative materials. Due to strong demand in all regions except South Africa, some export businesses were impacted by supply chain issues and increased shipping costs. Etex adapted its prices to offset the rapid increase in raw material and energy cost prices.

Exteriors registered a like-for-like1 revenue increase of 14.5% (+13.4% vs 2019) at EUR 648 million, mainly attributable to higher volumes in the residential facade and roofing segment (Cedral brand), driven by a strong surge in renovation and repair activities, both in Europe in Latin America. The revenue growth was also helped by pro-active price management mitigating the impact of input price increases. The architectural segment recovered further in 2021 but was still impacted by some projects being kept on hold. The agricultural sector was still exposed to long-term declining trends, yet our corrugated sheets demonstrated some competitive advantages compared to steel, which was impacted by price increases.

Industry’s revenue amounted to EUR 174 million, up by 11.8% like-for-like1 (-9.4% vs 2019). The division performed well in the fire-rated applications and appliances segment, which went back to pre-COVID levels in Europe, as well as the transportation and thermal process segments, while the oil and gas segment improved but was still impacted by low investments.

Our New Ways division, which was set up early 2020, recorded revenues of EUR 51 million in 2021, including the sales recorded by the recently acquired businesses in France, Ireland and the United Kingdom. The revenue of the pre-existing businesses, mainly comprising our light steel framing company EOS in the United Kingdom, went up from EUR 10 million to EUR 15 million, a combined effect of additional projects and selling prices which were adjusted to the price evolution of steel. New Ways revenues exclude our non-consolidated participations in several joint ventures.

Next to the significant organic growth recorded last year – as detailed in the previous pages – Etex also had a very busy M&A agenda:

The acquisition of URSA enabled us to further refine our strategic framework, which today focuses on four drivers across our five technologies: plasterboard, fibre cement, passive fire protection, offsite and modular solutions, and insulation.

Etex’s achievements in 2021 related to its “Engaged people” priority encompass the new edition of our ‘Me & Etex’ employee engagement survey, which registered a high 84% participation rate from our teammates, and showed an 86% engagement rate across Etex, up 15% on 2018 and 6% above sector peers. We also continued to acknowledge outstanding performances of our teammates through the Etex Awards, which have become a celebrated event across the organisation. In 2021, nearly 2,300 Etex Awards were handed out to Etex teammates worldwide. Last year we launched three 28-day Etex Challenges, with 3,000 teammates signing up. The goal was to bring teammates together worldwide, motivate them to complete activities for improved physical and mental well-being, and raise money for charity. Etex teammates logged an incredible 760,000 km of distance-based activities, resulting in more than EUR 17,000 donated to the NGO Habitat for Humanity.

To reach our ambitious targets in “Operational excellence”, our Purchasing and Supply Chain teams and processes have been challenged to ensure business continuity. The value of the various transformational programmes put in place in the last three years was demonstrated, and the robustness and agility of our teams confirmed. Etex also adapted successfully to high market demand and raw materials shortages at the supply chain and manufacturing levels last year, despite a highly volatile environment. At the same time, we continued to adapt our manufacturing footprint to stay competitive, while running several capital expenditure projects totalling nearly EUR 200 million for capacity increases or new facilities. In 2021, we invested EUR 35 million in improvements to our production facilities, which represent more than 2% of our manufacturing costs. In 2021, our safety performance was comparable to 2020, with a sharp reduction in the frequency of lost-time accidents and the total frequency of lost-time and medical aid accidents. Despite this, we sadly recorded two fatal accidents of workers of our contractors in Latin America, a stark reminder that there is no room for complacency.

To improve “Customer experience and Commercial excellence”, Etex accelerated its digital transformation and devised new ways of interacting with its customers. The My Etex digital platform, centralising all information and actions across every brand and division, is available to all customers worldwide to improve their digital experience. Trading customers can now place orders directly online. We have also optimised our ability to provide product information to customers via our websites, campaigns, social media channels and search engines. Our enhanced, centralised and stabilised digital marketing platforms provide the right information, at the right time, on the right channel.

Finally, the company reached new milestones last year to transform its ambitions in terms of “Sustainability and Innovation”. In 2021, Etex published its first-ever Sustainability Report, focusing on five themes: people, safety and well-being, community relations, environment and the shift to a circular economy. The report highlights some of Etex’s major commitments. In 2020, Etex became a signatory of the United Nations Global Compact (UNGC) for sustainable and responsible business practices, and committed to the 17 Sustainable Development Goals (SDGs) of the United Nations. Following a thorough internal assessment process in 2020, we have decided to prioritise the following sustainability areas: health, safety & well-being, decarbonisation, circularity, diversity & inclusion, and education. Etex also monitors its environmental, social and governance (ESG) risk exposure. In 2021, our rating of 18.1 out of 100 indicates our low risk exposure and favourable ranking amongst our peers. Our 2030 goals are ambitious, but in line with or slightly better than industry peers. We have worked hard to translate our ambitions into action plans and targets. These will be revealed in our next Sustainability Report, to be released later this year.

Etex expects demand to remain strong in the first half of 2022, on the back of dynamic repair and renovation activities, but the evolution in the second half of the year is more difficult to anticipate. Further recovery of project-related activities is also expected in 2022 but the ongoing raw material and energy price increases, volatility, the current war between Russia and Ukraine and potential disruptions linked to new COVID-19 variants, remain factors of uncertainty for 2022. All divisions will continue to proactively manage their cost-to-price performance which is key in the current high inflation context.

Changes to the Board of Directors

The mandate of Bernadette Spinoy as independent Director will be proposed to be renewed at the Shareholders’ meeting on 25 May 2022. Having reached the age limit, Gustavo Oviedo has decided to resign his mandate as independent Director of Etex. Consequently, it will be proposed to the Shareholders’ meeting to appoint a new independent Director. In addition, Bernard Delvaux was temporarily appointed by the Board of Directors to carry out the remainder of the Director’s mandate of Paul Van Oyen as from 1 January 2022. The appointment of BCConseil SRL, with Bernard Delvaux as its permanent representative, as Director will be proposed during the Shareholders’ meeting in May 2022.

The consolidated financial statements for the year 2021 were approved by the Board of Directors on 31 March 2022 and will be presented for approval at the Shareholders’ Meeting.

The statutory auditor issued an unqualified audit opinion on the consolidated financial accounts.

The 2021 Annual Report of the company is available on Etex’s website as of 4 April 2022 at the following address: https://www.etexgroup.com/annualreport2021.

Follow #PromatAsiaPacific on LinkedIn: